Prologue

This article is not intended to provide specific investment advice, it does not recommend that you buy or sell anything. The purpose of this article is to illustrate a transferrable framework that can be used as a tool to assign preliminary valuations to businesses. This framework, like all frameworks, isn't perfect and can't predict the future or answer the countless qualitative questions that should be considered when making an investment decision.

Business Valuation Vol 1: PayPal

Suppose you saw that PayPal's stock price had fallen in recent weeks and you're curious to know how it has performed throughout 2021, so you compare it to the S&P 500 as shown in Figure 1. Suppose you recently learned that PayPal owns Venmo, which you and a lot of people you know have been using for years. You begin wondering if now is a good time to buy PayPal stock.

Figure 1:

What Can You Do With This Information?

You've identified two things 1. PayPal has products that are widely used; 2. PayPal's stock price has underperformed the S&P 500 by about 44% YTD. That is not enough to make an informed investment decision, but let's say you're still curious. What could you do in order to make a more informed investment decision?

Fundamental Investing Concept Alert #1!

The fundamental concept of investing is to buy something for a lower price than you expect it to generate for you in the future, either from selling it and/or income it produces (for linguistic simplicity we will assume selling it includes any income it may generate). So there are only two variables to the investing equation 1. what you pay for something; 2. what you can sell it for in the future. For a publicly traded company its purchase price is always available. So the entirety of successful investing in public companies is to accurately predict what the market valuation of a company will be in the future, and then buy its stock if its priced materially below its predicted future value.

Ok, so maybe no duh. But we feel that the beginning is the usually best place to start.

Fundamental Investing Concept Alert #2!

As they say, something is worth what someone is willing to pay for it. In the broadest sense, assets can be categorized into Productive Assets and Non-Productive Assets.

- Productive Assets: produce something and/or provide tangible utility, which as an investment directly or indirectly generates cash flow. Eg. a farm, a bank, a manufacturing plant, etc. In general, Productive Assets are valued relative to how much they currently produce and/or are expected to produce in the future. A business that generates $5M in cash flow every year will necessarily still be valuable a decade from now, because receiving $5M in cash every year in perpetuity objectively has value.

- Non-Productive Assets: don't produce anything and provide little/no tangible utility. Artwork is the most obvious example. A painting might sell for $300M but only be comprised of $50 of paint and canvas. In general, Non-Productive Assets are valued solely on cultural significance, trends, and buyers' subjective preferences. A painting that sells today for $1M may only sell for $100K in a decade due to trends in the art scene and changing demographics. Since the painting doesn't produce anything it has no intrinsic value.

- There's inevitably some disagreement on this point, but in general.. You can invest in Productive Assets, while you speculate in Non-Productive Assets. However people can and frequently do also speculate in Productive Assets. Speculation in Productive Assets occurs when they are bought without regard for what they produce now or are expected to in the future. People often buy a stock simply because they've seen it go up, meanwhile they don't know anything about the underlying business.

Warren Buffett and his business partner Charlie Munger talk about having filters, such as the ones we discussed in our prior article. By this they mean a set of criteria they apply to any prospective investment in order to see if it is worth serious consideration. These filters allow Warren and Charlie to quickly (they say within minutes) eliminate most businesses from consideration as viable investments.

Capital MONEY! does not claim to be in the same stratosphere as Warren Buffett and Charlie Munger, but we do also have a filtering process.

- To start, if we don't already know it, we intentionally do not look at the Market Capitalization of the company in question. Looking at the Market Cap is like looking at the answer before trying to answer the math question yourself. It will almost certainly add bias to the valuation you land on. So we come to a valuation and then look at how it compares to the current Market Cap. If our valuation is materially below the current Market Cap, then it could be worth further research.

- To start the process, go to the company's investor relations site and look at their most recent 10Q (Quarterly report submitted to the SEC) & 10K (Annual report submitted to the SEC) and look at the Income Statement, Balance Sheet, and Cash Flows.

- Income Statement: We look at net income and how it changed Y/Y. We prefer businesses with positive and growing net income. We also like to look net income as a % if revenue and operating expense. These %s vary across industries and aren't valuable comparisons between companies in very different industries. But they give some insight into how difficult or easy an industry the business is in and/or how efficiently its run - especially seeing how the %s change over time.

- Balance Sheet: Our main focus is the ratio of Cash & Cash Equivalents vs Debt. We like a lot of cash and minimal debt. We also look at Equity for signs of share repurchases or additional stock offerings. Unless it is funded by debt the company will have difficulty repaying, share repurchases (aka buybacks) are generally beneficial for shareholders because each remaining share represents a larger ownership of the company. However, Equity on the balance sheet decreases when a company repurchases its stock, which has made equity and ROE less important in today's world of frequent share repurchases. In terms of financial statements we don't assign much value to intangible assets or goodwill, such things we might layer on qualitatively in our mental framework but assign a large margin of error to. If you need to split hairs it's not a good investment.

- Cash Flows: The fundamental purpose of a for-profit enterprise is to generate free cash flow (FCF). Free Cash Flow is comprised of three parts 1. Operating; 2. Investing; and 3. Financing.

- Operating is the cash generated or used from the running of the business and the fundamental purpose of the other two is to maximize operating cash flow over the long term and how to efficiently allocate it. It's generally not an encouraging sign if operating cash flows are negative. It means the company is either in a turnaround, is early in its life and alleging some kind of enormous growth or fundamental shift in its operations some time in the future.. or going out of business.

The financial statements are the first line of filters. Once we review them we come up with two numbers 1. what we think the business is worth; 2. what we think its current market cap is. We then see what the company's current market cap is and how it compares. If the market cap is materially above what we think the company is worth, then we can probably cross it off the list. If the market cap is materially below what we think the company is worth, it is still not enough to make an informed investment decision. But it is an indication that more thought and research could be worthwhile.

If a company makes it through these filters you should have an idea of your margin of safety. Effectively, margin of safety is a measure of how wrong you can be and not lose money. Say you valued the business at 105% above its current market cap - that is a small margin of safety. But say you valued the business at 170% of its current market cap, that means you have a bit of room to be wrong before you would lose money on it as an investment.

So at this point you have 1. your valuation of the business; 2. its current market cap; and 3. what you think is a big margin of safety. The next step is to try to find all the reasons why you might be wrong, and why the business might be worth a lot less than you think it is. You also want to research and account for any qualitative information that can impact the value of the business.

Some of the Qualitative Things to Ask About the Company You're Evaluating

- Is it in a growing or declining industry? Even an otherwise excellent business usually has poor results over the long term if it's in a declining industry. There can be money to be made, sometimes even for a long time, but it's more difficult and the margin of safety will usually be very small. Conversely, booming industries can carry even mediocre businesses to great results for a fairly long time, which helps to increase your margin of safety.

- How hard would it be for a different company to do what it does? Warren Buffett says he looks for a durable competitive advantage, which is when a business has something that provides differentiated value and would be very difficult or impossible for a competitor to replicate. He also uses the test "if I spent a billion dollars to start my own company in this industry, could I out compete this business?" With the point being, if a business can withstand a heavily funded competitor then it probably has a strong competitive advantage.

- Does it appear to have competent management? In most cases, bad management will ruin a good business more often than great management can save a bad business. Read shareholder letters, observe their decisions and actions over the past few years, listen to earnings calls and search for interviews.

- Are you sold on its strategic plan?

- What can't you know about the business and how much could that impact the accuracy of your valuation of it?

So What About PayPal?

Now having the framework we can apply it to PayPal. We'll start by looking at its financial statements from its latest 10Q, and provide high level observations in the order we think of things.

Income Statement:

- ~$1B of net income (profit) per quarter, with an annual run rate of ~$4.3B

- Ok, so it makes money.

- Profit is ~flat y/y while revenue is up. So that tells us to look for whatever it is that is costing more.

- Can begin to think about what kind of business PayPal is and what range of PE multiple you think is appropriate.

- ~$1B of net income on ~$6B of revenue. That's a fairly high profit margin, which tells us that PayPal probably operates in a favorable industry and/or has efficient operations.

- Weighted average shares are ~flat y/y so that tells us they haven't made large share repurchases or new issuances.

Balance Sheet:

- $13B+ in Cash and Cash Equivalents + Short Term Investments vs $8B in Debt. So they have ~2 years worth of earnings in debt, but they have a lot more in liquid current assets.

- $6.7B in Long Term Investments. Without knowing what the investments are it's unwise to assign too much value to such items, but it is a net benefit to have.

- ($10.4B) Treasury Stock, which says they've been buying back shares. It's also increased (gotten more negative) over the last year, which suggests they've been buying back more shares. Yet their weighted avg shares didn't seem to change much.. note as something to look into further.

Cash Flows:

Operating: $4.6B cash flow, fairly high relative to the $6B of revenue in the quarter. Stock based comp seems relatively high at first glance.

Investing: not a big story. Spend some money on property and equipment and an acquisition(s).

Financing: not a big story.

Next Steps

At this point you would, without having looked at PayPal's market cap, determine what your own valuation of the company. Then you would look at the market cap and get an idea of your margin of safety or if you valued the company at less than it's market cap.

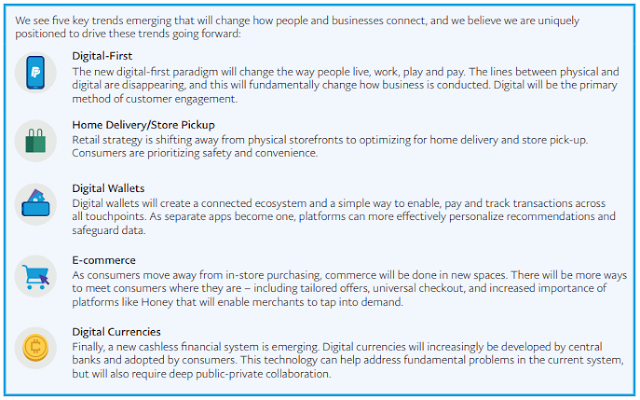

If it makes it through those filters, you could then try to identify all the ways in which you could be wrong. As well as answering the qualitative questions cited above, along with whatever else you think can materially impact the value of the business. During the process you can look at things such as the list of key trends that PayPal's CEO cited in his latest shareholder letter. Information like this can help inform you decision.

And as we said at the start, we are not making a recommendation to buy, hold or sell PayPal stock. We used PayPal as an example to apply a framework that we think may be a helpful tool in evaluating businesses.

We hope this was helpful and we'd love to hear from you!